Securing Success: Bagley Risk Management Services

Securing Success: Bagley Risk Management Services

Blog Article

Exactly How Livestock Danger Protection (LRP) Insurance Policy Can Secure Your Livestock Financial Investment

In the realm of animals financial investments, mitigating risks is paramount to making sure monetary stability and development. Animals Danger Protection (LRP) insurance stands as a reputable shield against the unforeseeable nature of the market, using a strategic method to safeguarding your properties. By delving right into the ins and outs of LRP insurance policy and its multifaceted advantages, livestock manufacturers can fortify their financial investments with a layer of safety and security that transcends market fluctuations. As we discover the realm of LRP insurance coverage, its function in protecting livestock investments becomes significantly obvious, assuring a path towards lasting economic durability in an unstable industry.

Comprehending Livestock Risk Defense (LRP) Insurance Policy

Comprehending Livestock Threat Security (LRP) Insurance is important for animals manufacturers aiming to reduce economic risks related to cost changes. LRP is a federally subsidized insurance policy product created to shield producers against a drop in market value. By supplying coverage for market value declines, LRP helps producers secure a floor price for their livestock, guaranteeing a minimal level of revenue despite market variations.

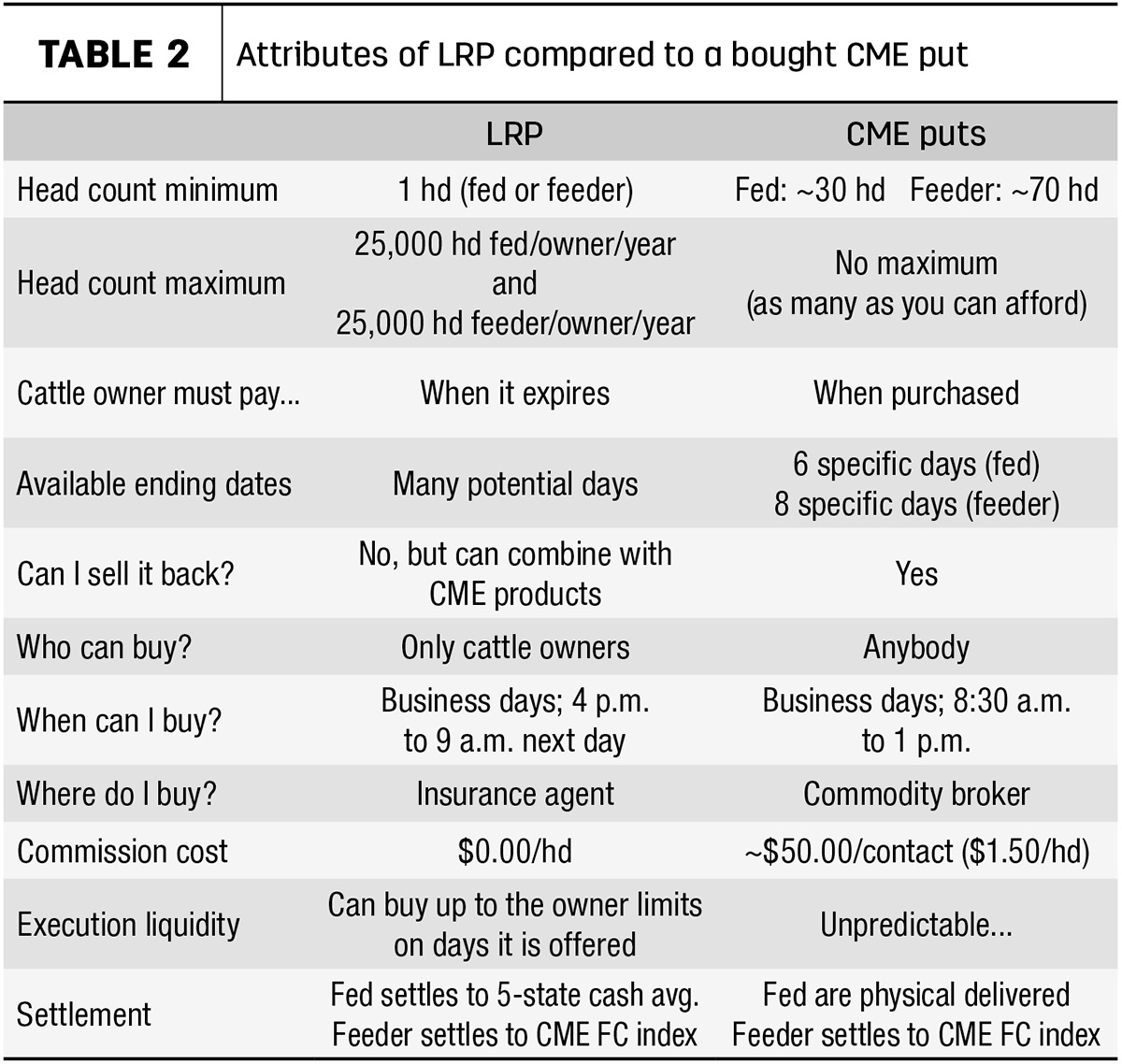

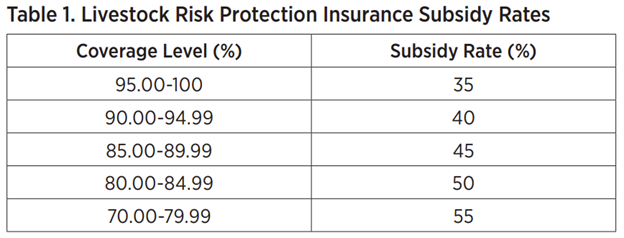

One secret aspect of LRP is its flexibility, allowing producers to tailor coverage levels and policy sizes to match their details requirements. Manufacturers can choose the variety of head, weight range, protection cost, and insurance coverage duration that align with their manufacturing goals and take the chance of tolerance. Recognizing these personalized alternatives is essential for producers to successfully manage their price threat exposure.

Furthermore, LRP is readily available for numerous livestock types, including cattle, swine, and lamb, making it a versatile threat management tool for livestock producers across various industries. Bagley Risk Management. By acquainting themselves with the details of LRP, producers can make educated decisions to guard their investments and guarantee economic stability despite market unpredictabilities

Benefits of LRP Insurance Coverage for Livestock Producers

Animals producers leveraging Livestock Danger Protection (LRP) Insurance policy acquire a tactical benefit in protecting their investments from rate volatility and safeguarding a stable financial ground among market unpredictabilities. One crucial benefit of LRP Insurance is rate defense. By setting a flooring on the cost of their livestock, producers can alleviate the risk of considerable monetary losses in case of market downturns. This permits them to intend their budgets better and make notified decisions about their procedures without the consistent anxiety of price changes.

Furthermore, LRP Insurance provides manufacturers with comfort. Recognizing that their investments are protected against unexpected market adjustments permits manufacturers to concentrate on other facets of their service, such as boosting animal health and wellness and well-being or optimizing production processes. This assurance can cause increased efficiency and earnings over time, as manufacturers can operate with more self-confidence and security. Overall, the advantages of LRP Insurance coverage for animals producers are significant, visit this site right here supplying a valuable tool for handling threat and making sure monetary safety in an unpredictable market setting.

Exactly How LRP Insurance Mitigates Market Dangers

Minimizing market risks, Animals Risk Defense (LRP) Insurance coverage supplies animals manufacturers with a trusted guard versus rate volatility and financial uncertainties. By providing security against unexpected price declines, LRP Insurance coverage aids manufacturers secure their financial investments and maintain financial security when faced with market fluctuations. This type of insurance permits livestock producers to lock in a rate for their animals at the start of the plan duration, guaranteeing a minimal rate level despite market modifications.

Steps to Secure Your Animals Investment With LRP

In the realm of farming risk monitoring, executing Livestock Threat Defense (LRP) Insurance policy includes a calculated procedure to secure financial investments look here against market variations and unpredictabilities. To safeguard your livestock financial investment properly with LRP, the first action is to analyze the certain threats your procedure deals with, such as cost volatility or unforeseen weather condition events. Next off, it is critical to research study and select a trusted insurance policy supplier that supplies LRP plans customized to your livestock and service requirements.

Long-Term Financial Safety With LRP Insurance Coverage

Making certain sustaining economic security via the usage of Animals Risk Security (LRP) Insurance policy is a sensible long-term method for farming producers. By including LRP Insurance coverage into their danger monitoring strategies, farmers can protect their animals financial investments versus unpredicted market fluctuations and adverse occasions that could endanger their financial wellness with time.

One key benefit of LRP Insurance for long-lasting financial safety and security is the tranquility of mind it uses. With a trusted insurance coverage in place, farmers can alleviate the economic risks connected with unpredictable market conditions and unexpected losses because of aspects such as condition break outs or all-natural calamities - Bagley Risk Management. This stability allows manufacturers to focus on the everyday procedures of their livestock service without continuous fear regarding potential economic problems

Moreover, LRP Insurance provides a structured technique to taking care of risk over the long term. By setting details coverage degrees and choosing proper endorsement periods, farmers can tailor their insurance coverage intends to line up with their monetary objectives and take the chance of tolerance, making certain a sustainable and protected future for their animals operations. To conclude, investing in LRP Insurance my link coverage is a proactive approach for agricultural manufacturers to accomplish long-term monetary safety and security and shield their livelihoods.

Verdict

In final thought, Livestock Threat Protection (LRP) Insurance coverage is a beneficial tool for livestock producers to mitigate market risks and safeguard their financial investments. It is a sensible selection for protecting livestock financial investments.

Report this page